How Do Retirement Investment Companies Make Money

Don't let high costs eat away your returns

They say you have to spend money to make money. But the money you pay to invest has a big effect on what you have left in your own pocket.

POINTS TO KNOW

- All investments have costs.

- Money you lose to costs compounds (rises exponentially) over time.

- Because investments with higher costs have to overcome these expenses, their performance tends to suffer vs. lower-cost investments.

Understand what you're paying

Every investment has a cost, even if you don't realize you're paying it.

There are many different kinds of costs, but they all have one thing in common: If the money is going somewhere else, it's not going to you.

Why do costs matter?

Investment costs might not seem like a big deal, but they add up, compounding along with your investment returns. In other words, you don't just lose the tiny amount of fees you pay—you also lose all the growth that money might have had for years into the future.

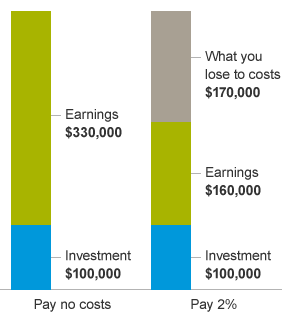

Imagine you have $100,000 invested. If the account earned 6% a year for the next 25 years and had no costs or fees, you'd end up with about $430,000.

If, on the other hand, you paid 2% a year in costs, after 25 years you'd only have about $260,000.

That's right: The 2% you paid every year would wipe out almost 40% of your final account value. 2% doesn't sound so small anymore, does it?

Costs can eat away at your investments

This hypothetical illustration doesn't represent any particular investment nor does it account for inflation. "What you lose to costs" represents both the amount paid in expenses as well as the "opportunity costs"—the amount you lose because the costs you paid are no longer invested. There may be other material differences between investment products that must be considered prior to investing. Numbers are rounded.

What can you do to control your costs?

Because all investments have costs, it might seem like a waste of time to worry about them. Or maybe you assume that a higher price means higher quality.

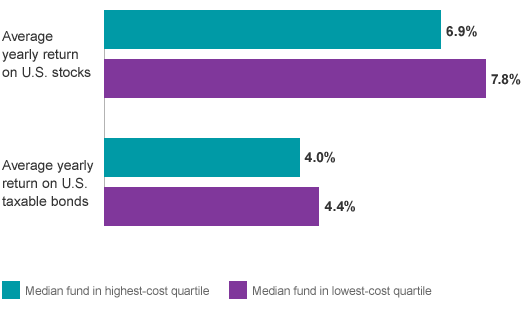

But nothing could be further from the truth. Research on mutual funds has shown that higher-cost funds generally underperform lower-cost funds.* That's because the fund managers charging these costs have a difficult time adding enough value to overcome the additional expense.

Funds with lower costs have outperformed more expensive ones

This illustration compares the annualized returns (for the 10 years ending December 31, 2014) of the median funds in two groups: the 25% of funds that had the lowest expense ratios as of year-end 2014 and the 25% that had the highest, based on Morningstar data. Returns are net of expenses, excluding loads and taxes. Both actively managed and index funds are included, as are all share classes with at least ten years of returns. Source: Vanguard calculations using data from Morningstar.

Don't get fooled by marketing tactics

Some funds may charge extremely low expense ratios—but add front- and back-end loads. Or they may offer an "introductory" or short-term expense ratio that increases later on. Or they might undercut their costs on one fund but jack up costs on the others to make up for it.

The bottom line?

There are certainly some things you shouldn't bother worrying about when it comes to investing. But costs are one of the driving factors that dictate whether you'll reach your goal—and they're one of the only factors completely within your control. So give them the time and attention they deserve.

How Do Retirement Investment Companies Make Money

Source: https://investor.vanguard.com/investing/how-to-invest/impact-of-costs

Posted by: halelited1977.blogspot.com

0 Response to "How Do Retirement Investment Companies Make Money"

Post a Comment